So, how much return will my social media advertising program generate, and by when?

Return on ad spend (RoAS) is a question many of our clients and prospects ask upfront when looking to launch a new social media and digital advertising program.

The answer, even for a firm like ours with over a decade of experience running successful campaigns for our clients, is unfortunately not straightforward. That said, there are a number of concepts and factors you can think about to better understand what you can expect.

How Do You Measure Digital Marketing Return?

So, how do we even measure return? The typical measure is return on ad spend, which is revenue that directly results from the social media advertisements, divided by the ad spend spent to generate those sales.

A few caveats and considerations, however. The number is almost always underestimated for three major reasons:

- The date range you are looking at captures the spend during that time frame and the revenue in that same date range, but doesn’t factor in the fact that the dollars spent may generate additional future returns when that prospect comes back to the site later to purchase.

- There is also some loss of tracking for users that block Facebook’s pixel tracking and for users that may move across devices, discovering a business via Facebook or Instagram on their phone and later googling it on their laptop or tablet, for example.

- True return should also include the concept of the Lifetime Value (LTV) of a new customer. This is especially important for some businesses that have a high rate of repurchase and/or a long retention period for customers (e.g., on a monthly subscription). In those cases, it can be more relevant to use the LTV to calculate their RoAS, instead of simply including the initial purchase value.

The Stages of RoAS Progression

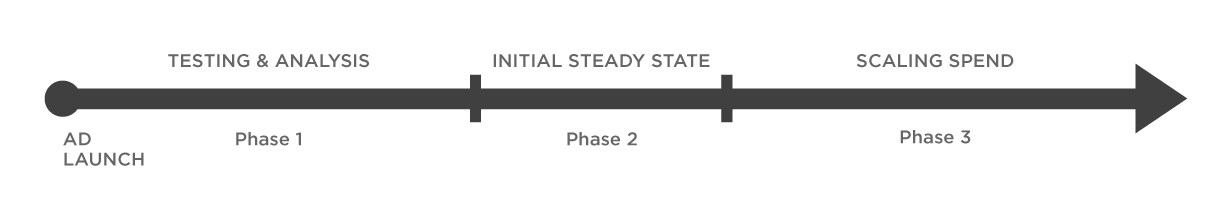

The following diagram illustrates the way we think about the progression of an account’s RoAS.

Every new account, and oftentimes even new campaigns, starts with an initial testing phase where the focus is primarily on testing messaging, creatives, and targeting. Depending on the budget size, the account may only be able to afford to test one of these at a time. At this stage, businesses should expect their RoAS to be less than 1x, as this phase is an investment in order to make stages 2 and 3 all the more effective. Over the course of stage 1, the team focuses on narrowing down the top-performing variables.

Eventually, that brings us to stage 2, where the account is making a profit from its ad spend. At this stage, the ads are generating revenue that is greater than the money being spent on placing the ads. Of course, that brings us to stage 3, where we logically want to increase the ad spend to increase the return.

But how long does each stage actually last? And how many multiples of my ad spend can you expect to eventually receive? Well, it depends. But there are three main factors to take into consideration to measure your expectations.

Factor 1: Brand and Category Maturity

I group brand and category maturity together because the concepts are similar, though in reality, they are stacking factors that impact RoAS. The first thing to consider is if the product or service category is already well known by target customers. For example, customers who have a prescription to improve eyesight are clearly aware of the product categories of glasses, contact lenses, and laser eye surgery. A client launching a new vitamin that helps people quit smoking by providing specific nutrients that are depleted by smoking is essentially creating a new category of smoking cessation product. Customers will be much more familiar with patches or gum to help curb cravings, so there will be an additional layer of education required for this new product category.

Then comes the question of whether the audience has heard of the company or brand before. For example, there are companies who have an established customer base who already know their physical retail locations. These companies who decide to start selling online can leverage that brand awareness to quickly generate sales in this new channel. A brand new company, conversely, will need to recognize that it will likely take additional time to create a high-converting digital marketing program, because there is the credibility and trust-building component that must first take place for the brand.

The more mature the category and brand, the faster you can achieve your initial steady-state RoAS.

Relatedly, new brands will have other non-ad-spend costs in the early months to create and establish the brand. These will include things like brand strategy, visual brand identity (logo, colors, etc.), website design and development, social media strategy, property setup, and all other aspects of digital marketing strategy and setup. It will be much more difficult to measure the direct ROI on these upfront investments, but they are critical to getting right in order to position the brand effectively and maximize conversion potential, which leads us nicely into Factor #2.

Factor 2: A Strong Brand, Product, and Website, Optimized for Conversion

I am again grouping several related, but separate, factors together that share the same root: do customers need your product, and have you created an effective brand and website foundation to entice the customer to purchase or inquire?

Another way of saying this is that you can have the best advertising program in the world, targeted to your ideal customer and drawing them in with compelling ad creative at a reasonable price, but if they land on a clunky website that looks unprofessional or untrustworthy, or that simply doesn’t capture their attention with more of what brought them there, your ultimate conversion rate will be much lower than it could and should be.

User experience issues on the site, such as confusing language, a complex navigation structure, or a complex purchase or inquiry process can all have significant negative effects on conversion rate.

Similarly, a poorly designed site with text-heavy paragraphs or a lack of clear, compelling imagery to capture the users’ imagination is a big missed opportunity.

Factor 3: Average Purchase Price and Product/Service Lifecycle

The third major factor relates to the average purchase price, as well as the product or service lifecycle (e.g., repeat purchase rate, frequency of purchase). For example, we’ve worked with a client in the premium health and nutrition space who launched a protein chocolate bar sampling program, offering 2 flavors for $6.99. With this low purchase price and competing against other companies to get in front of the same premium diet and fitness audience, it can be challenging to get cost per sale down to a low enough level to see a RoAS of several multiples. But for a new brand that has the potential to see many ongoing repeat purchases, as frequently as monthly, and even offers a monthly subscription option, acquiring customers at a price that results in the achieved 1.58x RoAS is still very strong. When looking at the return on the investment to acquire that customer vs. the full lifetime value of that customer you could easily be looking at a 20-30x+ return.

Meanwhile, for a prescription eyeglasses eCommerce company whose average sale price is $150, we can achieve higher RoAS multiples like 7-8x, given the higher purchase price. Even this client’s loyal customer base, who may buy from them for many years, isn’t buying frequently, however. They may make a purchase every 1-3 years, so it is more important to see a higher upfront return, even though you can still see a 20-30x+ return on lifetime value, as well.

If you have a product that sells for $5 and is not a product that will be purchased often, logic would dictate that this may not be a prime candidate for social media advertising. The cost to acquire the customer will likely be around the purchase price of the product and if you do not have repeat purchase or upsell potential, the economics do not make sense.

For B2B companies who are generating leads through social media, they need to also factor in the average sales cycle from the time of lead capture until they start to see a return, but also the time upfront to test and provide feedback on lead quality to refine the advertising program to increase overall quality of leads. Yet for some B2B firms whose services may cost tens or hundreds of thousands of dollars, even one converted lead could generate a significant return on the entire program investment.

It is these business models and product/service economics that ultimately dictate the level of upfront RoAS that is possible and the lifetime customer return, which can then be evaluated to determine feasibility.

So Where Does That Leave Us?

With all of this in mind, brand new businesses and startups should expect a <1x return in the early days, especially factoring in the full marketing cost. It simply costs more than you will immediately get back in revenue to establish the brand, website, social media presence and begin to test ad messaging, audience targeting, offers and creatives, while also tweaking and improving your website conversion rates. It may take 6-12+ months to start generating a true positive return on your marketing investment.

An established eCommerce store that launches a new social media program, including social media advertising, to work alongside an already well-converting website, may see a positive return within 2-5 months.

B2B brands who are generating leads through social media advertising should expect several months of lead quality refinement, and for those with a very high cost to engage, it may take many months before there is a closed business that directly results from an ad, though there may be additional benefits such as increased brand awareness that are not directly tied to ad lead capture.

Have additional questions on how these concepts apply to your business?